#Industry News

Automotive TFT LCD revenue has surpassed smartphone TFT LCD

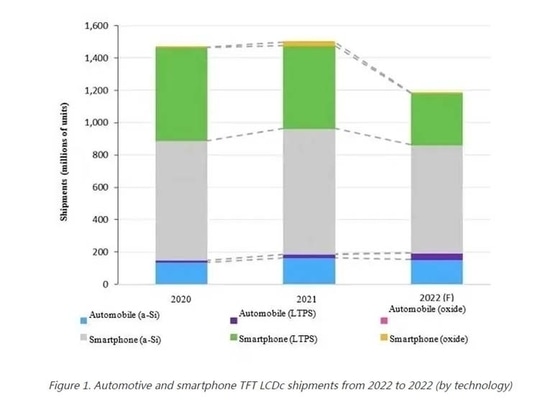

According to the latest report from Omdia titled “Mid-to-Small Size Display Panel Market Tracker,” the shipment volume of TFT LCD panels for smartphones significantly declined to 990 million units in 2022.

I. Automotive TFT LCD vs. Smartphone TFT LCD: Shipment volume is higher

According to the latest report from Omdia titled “Mid-to-Small Size Display Panel Market Tracker,” the shipment volume of TFT LCD panels for smartphones significantly declined to 990 million units in 2022.

Due to the surge in oil and energy prices leading to rapid inflation, the demand for smartphones slowed down in 2022.

Additionally, the further adoption of AMOLED panels in the smartphone market resulted in a year-on-year (YoY) decline of 25% in TFT LCD panel shipments in 2022.

According to the November 2022 report from “Display Dynamics,” despite the sluggishness in the smartphone display panel market, LTPO AMOLED panel shipments are expected to grow.

The growth in AMOLED (especially with LTPO technology) is driven by its lower power consumption, which offers higher value. Strong consumer demand for Apple’s new iPhone 14 Pro and Pro Max series has also contributed to this growth.

Meanwhile, the demand for electric vehicles steadily increased in 2022 as consumers opted for more sustainable vehicle choices due to rising oil prices and environmental considerations.

According to Omdia’s latest report, TFT LCD panel shipments for automotive applications saw a slight increase of 4% to 195 million units in 2022.

As shown in Figure 1, despite the growth in TFT LCD shipments for automotive use, it is unable to compensate for the overall decline in mid-to-small size TFT LCD panel shipments, mainly due to the significant decrease in TFT LCD panel shipments for smartphones.

II. Automotive TFT LCD vs. Smartphone TFT LCD: higher output value

As the report shows, automotive TFT LCDs of 9.0 inches and above offer better functionality. Due to the promotion of autonomous driving technology and the increase in the complexity of car navigation functions, car displays are becoming larger and larger.

As shown in Figure 2, in 2022, the average size of a-Si TFT LCDs for automotive displays increased to 8 inches, and it is projected that the average size of LTPS TFT LCDs will exceed 10 inches.

Figure 2. Average size of automotive and smartphone TFT LCDs from 2020 to 2022

Figure 2. Average size of automotive and smartphone TFT LCDs from 2020 to 2022

In contrast, the average size of a-Si TFT LCDs for smartphones has remained stable at around 6.5 inches, and LTPS TFT LCDs have an average size of 6.4 inches, with limited growth potential.

According to IT House, due to the production process requirements of automobile displays, the need to use durable materials to withstand long-term operation in a wide temperature environment, and the increase in the size of automobile screens. Therefore, the price of automotive display panels is higher than that of smartphone display panels.

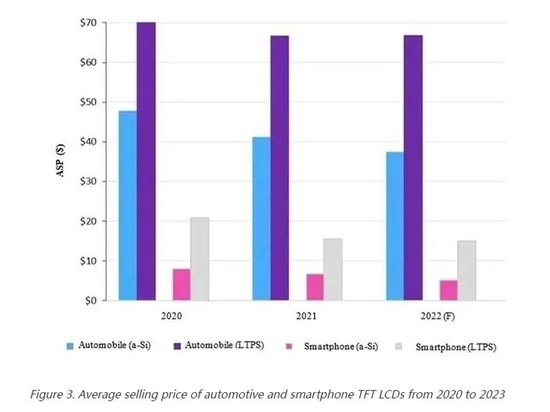

As shown in Figure 3, the average selling price of TFT LCDs used in automotive displays and smartphones. The small and medium-sized TFT LCD market has fierce price competition and sluggish demand.

Under tough market conditions, the average selling price of smartphone a-Si TFT LCD dropped to US$5, while that of LTPS TFT LCD dropped to US$15 in 2022 .

At the same time, the average selling price of automotive TFT LCDs has also declined, but remains higher than the average unit price of smartphones. Average selling prices for automotive a-SI LCD and LTPS LCD in 2022 will be $37 and $67 respectively.

III. Conclusion

Smartphone TFT LCD shipments are expected to decline sharply by 25% YoY in 2022. Likewise, lower average selling prices due to price competition means overall TFT LCD revenue for smartphones will decline 38% YoY in 2022 to $8.17 billion.

On the other hand, despite unfavorable market conditions, automotive TFT LCD revenue increased slightly in 2022, reaching $8.5 billion, a YoY increase of 3% as shown in Figure 4.

Omdia predicts that in 2022, the revenue from automotive TFT LCDs surpassed the revenue from smartphone TFT LCDs, including both smartphones and feature phones.

To sum up, global events such as soaring energy prices and inflation will lead to a decline in the smartphone market in 2022. Smartphone demand for TFT LCD may recover from 2023.

However, it is expected that AMOLED panels are likely to absorb the growth in demand for smartphone display panels. TFT LCD demand recovery is likely to be limited to low-end smartphone products.

According to market development trends, it is expected that the number of display devices installed in each vehicle will continue to increase, and the screens will be larger and higher resolution, which will promote the expansion of demand.

With profits in the smartphone market already sluggish, the automotive display market, as the last battlefield for small and medium-sized TFT LCD manufacturers, is becoming increasingly important.