#Industry News

Global Display Equipment Investment Rebounds 54% to 55.78 Billion Yuan in 2024

According to the latest forecast by market research firm DSCC, global display equipment investment is expected to rebound 54% in 2024, reaching $7.7 billion, which is still down by about half compared to 2020 (around $16 billion).

According to the latest forecast by market research firm DSCC, global display equipment investment is expected to rebound 54% in 2024, reaching $7.7 billion, which is still down by about half compared to 2020 (around $16 billion). In 2023, global display equipment investment declined 59% to $5 billion.

In December 2023, DSCC had forecasted global display equipment investment to reach $4.7 billion in 2023 and then rebound to $8.5 billion in 2024.

Compared to the latest forecast, the 2023 investment size has increased by $300 million, while the 2024 investment size has actually decreased by $800 million.

The data shows that among panel manufacturers, Samsung Display is expected to account for 31% ($2.4 billion), ranking first. Next is Tianma at 28% ($2.2 billion), followed by BOE at 16% ($1.2 billion).

In terms of factories, Samsung Display’s A6 8.6-generation OLED production line for IT applications is expected to account for 30% ($2.3 billion) of global display equipment investment this year.

Next are Tianma’s TM19 8.6-generation LCD factory (25%), and TCL CSOT’s T9 8.6-generation LCD factory (12%).

Then BOE’s B20 6-generation low-temperature polycrystalline silicon (LTPS) LCD factory (9%).

Among equipment manufacturers, Japan’s Canon and Canon Tokki are expected to account for 13.4% ($1 billion) of the global total, a 100% increase from last year. Canon Tokki ranks first in the deposition equipment field, and Canon ranks second in the exposure equipment field.

The US equipment manufacturer Applied Materials (AMAT) ranks second, accounting for 8.4% ($650 million), a 60% increase from last year.

Next are Japan’s Nikon, TEL, and V Technology. Among the top 15 companies, half are expected to see display equipment sales grow more than 100% year-over-year (YoY).

In terms of technology, LCD equipment investment ($3.8 billion, 49%) is expected to exceed OLED equipment investment ($3.7 billion, 47%). The remaining portion is an investment in equipment needed for micro-OLED and micro-LED.

In 2024 display equipment investment, the share of IT product panel fabs is expected to be the highest at 78%. The mobile segment accounts for 16%.

In terms of thin-film transistor (TFT) technology, oxide accounts for the highest share at 43%, followed by amorphous silicon (a-Si), low-temperature polycrystalline oxide (LTPO), low-temperature polycrystalline silicon (LTPS), and complementary metal-oxide-semiconductor (CMOS). By region, China accounts for 67% and South Korea 32%.

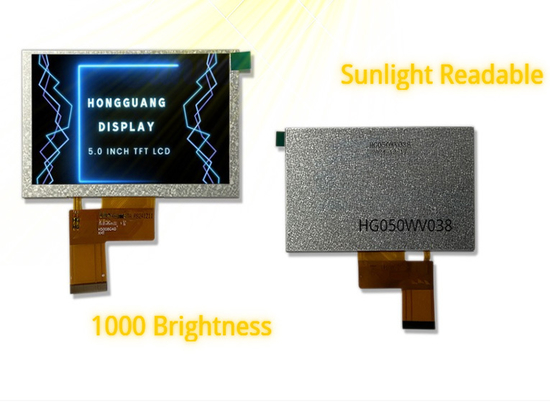

As a manufacturer specializing in the production of TFT LCD, Honguang Display has a certain share in global display equipment investment.

According to the report data, the Chinese market is expected to account for 67% of global display equipment investment, and Honguang Display, as an LCD manufacturer in China, will undoubtedly benefit from it, and its investment scale is expected to further expand this year.

With the overall rebound in global display equipment investment, Honguang Display is expected to further enhance its own strength in future market competition and consolidate its leading position in the LCD field.